I myself was once a victim of frequent trading. I cannot say that frequent trading is a sure path to ruin, but it is indeed very difficult to make a profit from it. Even now, after more than a decade of trading with a relatively stable mindset and financial situation, if I were to return to a state of frequent trading, I might still be unable to control my state, as human nature is too hard to overcome.

In the early days of my trading, I could execute dozens of orders in a single day, from noon till night without a break. I could skip meals and sleep, but trading had to be done.

Later, when I looked back on my state, I felt that there were two main reasons for my losses:

1. Extremely high trading costs.

At that time, with dozens of trades a day, coming in and out, coupled with my lack of understanding of the industry, my account was secretly charged with hidden spreads and fees. I didn't notice it at first, but by the end of the month, it was basically a loss upon a loss. When I later reviewed my trading costs, I was shocked. Even without hidden spreads, frequent trading would also result in high fees, which was not worth it.

2. Frequent trading is highly likely to lead to emotional loss of control.

That was my case. Frequent trading would put you in a state of extreme excitement because trades come and go with wins and losses, and the results come quickly, which is very intoxicating.

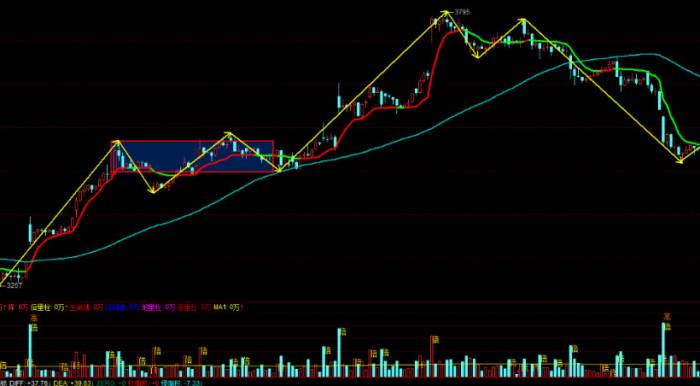

After getting intoxicated, so-called technical standards were useless; I just wanted to follow my mood. For example, I used to draw trend lines on 5-minute K-lines for breakout trades. After consecutive losses and losing my rationality, I didn't care whether the trend lines broke or not; any technical standard could become a reason for me to make a trade. I felt unwilling and wanted to try again. Seeing the market drop a bit, I thought it would rebound, so I hurriedly made a trade.

The original trading plan was also useless. I had set rules for myself, such as how much position to take and how to add positions, but all the rules became ineffective. Originally, I would trade 0.5 lots or 1 lot at a time, but after losing eight or ten times in a row, I wanted to quickly recoup my losses. So, I would find an opportunity that I thought was good and go all in with 10 lots at once, thinking I could make up for all the previous losses in one go.

The result was that during the holding process of 10 lots, I was extremely excited until the market moved against me and I had to stop the loss. I felt like a balloon that suddenly burst, deflated all at once. It was in this cycle of extreme excitement and extreme disappointment that I exhausted all my energy and spirit.In fact, the greatest risk in trading is not the failure of your techniques, but the loss of control over human nature.

When you trade frequently, your full attention is on the market, and your emotions are carried away by it. The market can make you cry, make you laugh, and make you lose control, just like a gambler who has lost their mind and won't stop until they are wiped out. This is the magic of the market.

So the only way not to lose control is not to trade frequently and not to become a slave to the market.

How should you approach frequent short-term trading?

You can trade short-term, but you need to control the frequency and maintain a distance from the market.

There is a common phenomenon in trading that beginners prefer short-term trading because it has a high frequency, short holding periods, and does not require long-term waiting, which tests patience less. I actually understand this eagerness to know the outcome quickly because human nature is to seek quick success and instant benefits.

But if you really want to do well in trading, you still need to control the frequency. For example, if you are a full-time trader, control your trading frequency to within 10 times a day, stick to a fixed variety, and ensure that you can operate smoothly without being flustered. If you are a part-time trader, you can control the trading frequency to 1-2 times a day, so you don't have to watch the market frequently and can balance life.

When you maintain a certain distance from the market and trading, you will find that the sky is bluer, the air is sweeter, and there is no feeling of being overwhelmed by the market, so you will have ample mental capacity to think and remain rational.

Additionally, you must have your own trading rules when doing transactions.

For example, a complete short-term trading system with detailed refinement, clear standards, and strict money management rules, so even if you trade frequently, you can follow your own rules, of course, this also requires strong self-control.Finally, a reminder is also in order: when engaging in transactions, it is crucial to pay attention to your own transaction costs.

I've noticed that many people overlook this aspect, but sometimes transaction costs can significantly reduce a large portion of your profits. It's already challenging to make a profit from trading, and it becomes even more difficult after accounting for transaction costs. Therefore, it's important to be vigilant about whether your account is being charged hidden fees or if the fees are reasonable.

To conclude, the purpose of our trading is to make money, not to satisfy an addiction to trading. Do not become a slave to your own desires.

Comments