To analyze this issue, we must start with the fundamental logic of "thinking big but acting small."

The essence of "thinking big but acting small" is to use the direction of the larger time frame as a reference and enter through the smaller time frame to reduce the stop-loss, capturing the trend of the larger time frame to achieve a high reward-to-risk ratio. Alternatively, it involves leveraging the certainty of the direction in the larger time frame, entering in the smaller time frame in line with the larger direction, and exiting to make small time frame swing trades, which can increase the success rate.

There is a hierarchical relationship between the large and small time frames, with all trades taking the larger time frame as the standard. This is akin to an army in battle, where the small time frame represents the soldiers, and the large time frame represents the commanding officers; the soldiers must follow the direction set by their commanding officers.

Therefore, in the practical application of "thinking big but acting small" trading, once the larger time frame is determined, we only trade in the smaller time frame in the direction of the larger time frame. Suppose the larger time frame is bullish, and the smaller time frame shows a bearish breakout, turning the smaller time frame bearish. At this point, the larger time frame remains the same as the original bullish trend, with no breakout or shift to bearish. This minor breakout is not an opportunity for our trade, and we should do nothing.

It is a contrarian trade with a poor reward-to-risk ratio and a low success rate. We should wait for further development and enter the market when the smaller time frame also forms a bullish breakout.

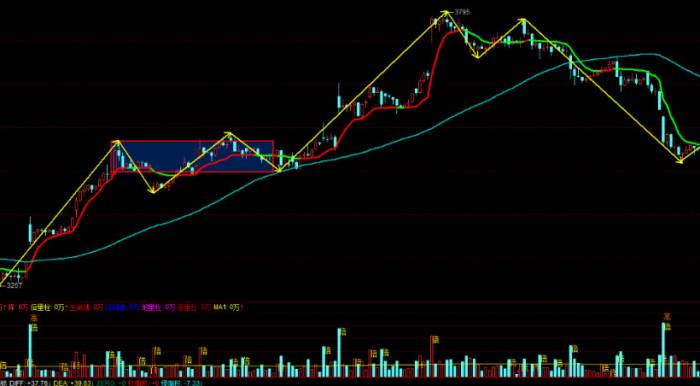

The chart shows the GBP/USD candlestick, with the left side being the 1-hour level, where the candlesticks represent the larger time frame, and the right side is the 5-minute level, where the candlesticks represent the smaller time frame.

First, look at the left side of the chart. After two bottoming reversals near 1.20950, the market broke upward, breaking the downtrend line, and the trend shifted from bearish to bullish, establishing a bullish trend. At this time, the larger direction is bullish.

Switch to the 5-minute level on the right side of the chart. Here, the market first formed a bearish breakout of the downward trend line, which is the red trend line in the chart, and the breakout point is the red circular position in the chart. This bearish breakout is not traded.

Wait for the market to form a bullish breakout of the downward trend line in the 5-minute level before entering, which is the blue trend line and the blue circular position in the chart. After the order is entered, the market rises significantly.

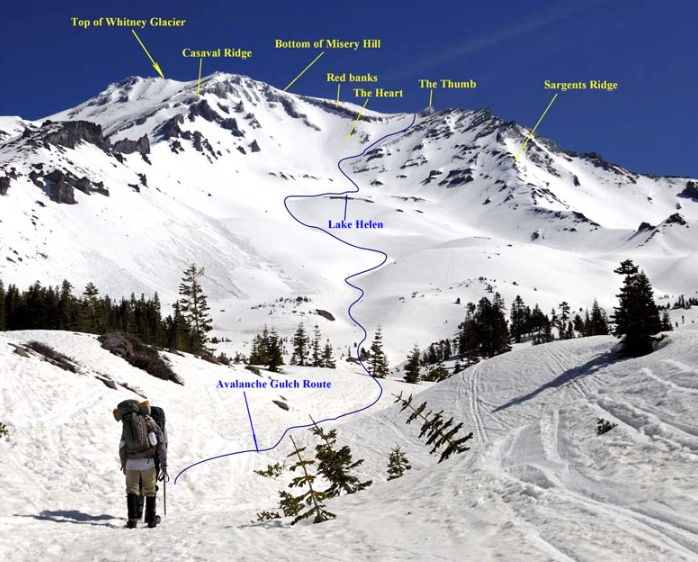

The trading logic of "thinking big but acting small" leverages the speed and power of the larger trend to make profits in the smaller time frame. It is like riding a bicycle to school as a child, when encountering a tailwind, the ride is easy and fast, and you can hum a tune as you arrive. When facing a headwind, you have to pedal hard, panting with exhaustion, and the speed is still slow.The chart depicts the daily candlestick chart of the Euro to US Dollar exchange rate. During a continuous downtrend, the price fell from 1.1276 to 1.0500, representing a significant bearish trend.

Within this bearish phase, the red arrows indicate the downward trend, while the blue arrows signify the upward corrections. It is evident that the space occupied by the red arrows, representing the downward movement, is much larger than that of the blue arrows. In this market segment, for those trading on a smaller scale, whether following the trend or trading in waves, the profit from going short in line with the trend would certainly be much better than attempting to go long against it.

Of course, there are also numerous opportunities for small-scale breakouts to the upside during this trend. However, on a larger scale, there has been no breakthrough, no change in direction. If one were to enter the market on a small-scale breakout, the profit space would be minimal, and the success rate would be low, making it an unwise move.

In summary, since our approach is to observe the larger picture and act on the smaller one, once we have identified the larger trend, we should follow it. Abandon any small-scale breakouts that go in the opposite direction.

Comments