When it comes to major trends, many friends are definitely interested. Major trends = big space = big profits. Everyone wants to seize such opportunities.

Last week, I shared the stories of two champions from futures trading competitions. Their accounts also fluctuate on a regular basis. The reason they suddenly became famous is because they caught several major trends and multiplied their profits several times over.

Indeed, small profits rely on diligence, while big profits require the right timing, favorable conditions, and the right people. Heroes are made by the times. Without major trends, even the most skilled traders will be greatly diminished.

Catching major trends actually requires some know-how and skills, as well as long-term training and observation. Today, I will share my 4 methods for finding major trends in trading based on my own experience over the past decade or so, and I welcome friends from all walks of life to share their methods in the comments section.

Major trends are divided into two categories:

One is the major trend after a reversal, where the market continues to rise or fall, and then reverses after reaching an extreme, just like the alternation of day and night, and the natural principle of decline after reaching the peak.

The other is the major trend in continuation, where the market has already started, then enters a long-term consolidation trend, and after accumulating strength and breaking through, the market forms a major trend.

Next, I will share 4 specific practical methods for finding major trends.

1. After a significant rise or fall in the market, a major trend in the opposite direction will appear when it diverges from the fundamentals.

In the futures market of 2023, soda ash is definitely a star product.In the first half of the year, there was a significant drop, with widespread losses, but in the second half, the 2401 futures contract reached a low of 1370 before stabilizing and then surging. Many traders who achieved good results in this year's futures trading competition capitalized on the bullish trend of soda ash.

The price of 1370 is already very close to the limit of the production cost of soda ash. According to the financial data of listed companies published online, Shandong Haihua, which uses the ammonia-soda process, has an annual output of 3 million tons, and the average production cost over the five years from 2017 to 2022 ranged from 1218 to 1490.

Moreover, since 2022, the conflict between Russia and Ukraine has led to a surge in natural gas prices, resulting in an increase in the international production cost of soda ash and a decrease in output. In 2022, the export of soda ash was 2.0549 million tons, with imports at 113,800 tons, resulting in a net export of 1.941 million tons, setting a 10-year high.

Under such high demand for soda ash, the price has paradoxically plummeted, creating a divergence between the fundamental demand and the product price, which is a good opportunity for a bottom-fishing turnaround.

After the 2401 contract fell to 1370 in May, it underwent more than a month of bottom consolidation and formed an upward breakthrough at the bottom in mid-July, followed by a significant rise in the market.

Note:

(1) This kind of divergence between fundamentals and price is quite common in domestic futures, similar trends have been seen in the past few years with live pigs, eggs, coke, and other such commodities.

(2) The frequency of such divergences between fundamentals and price is not high, and these opportunities require patience to wait for, but they are worth the wait.

(3) Even when the opportunity arises, one must also pay attention to risks, use a position that one can afford, and avoid leveraging too much. After the trend emerges, it is even more important to have the patience to hold onto the orders.2. After receiving support or resistance at historically significant support and resistance levels in the market history, a significant trend emerges.

Among all market trends, there is a rather special type of position, which is the historically significant support and resistance levels in the market's history. These levels are often key positions recognized by market participants, with a very low probability of being breached. Once the market tests these levels, the likelihood of a reversal and a significant trend is very high. The chart below shows the monthly chart of the Shanghai Composite Index. Since the bull-bear transition in the stock market in 2015, the support level of 2800-2900 has become the most special and important historical support level in China's stock market over the past 8 years.

Every time the market tests this support zone, it forms a significant upward bullish trend. Correspondingly, we select stocks in the stock market that are closely related to the Shanghai Composite Index, such as securities stocks, because securities stocks are the first to move when the stock market rises, and there is always a very good profit. In recent years, there have been at least five or six significant trend profit opportunities.

In fact, this also exists in other markets. For example, last year, the euro fell to 0.95 against the US dollar, and after breaking through the 1:1 exchange rate, it found support and formed a significant bullish trend. Spot gold rose rapidly after the pandemic in 2020, reaching a historical high of 2074. In March 2022, this historical high resistance was tested once and did not break, and then the market fell rapidly, reaching a low of 1621.

In April 2023, this historical high was tested again and did not break, and the market also fell significantly, reaching a low of 1812. These opportunities have a very high success rate and are significant trend trading opportunities.

We can take advantage of these opportunities to ride a significant trend. If the time cycle for trading the significant trend is too long and tests patience, we can also continuously trade in line with the trend at a smaller scale during these more defined market phases.The significant support and resistance levels of such historical market trends are quite important. Let me further illustrate this with a picture of gold.

The chart shows the weekly chart of spot gold. The 2074 level at the top is a historical high resistance level, and the market has tested it twice, both times resulting in significant declines. Additionally, the 1670 level at the bottom is also a very important horizontal support level, providing similar support.

Note:

Such trading opportunities are rare. In the domestic stock market, there are only six trading opportunities in eight years. In the foreign exchange and gold market, over a period of three years, there are only about ten trading opportunities, but each time the accuracy is very high. After the market reverses, it is a major trend, and the profits are very considerable. It is a trading opportunity well worth waiting for.

Few opportunities, but good ones. If you do well with these opportunities, the profits are not inferior to those of traders who are constantly busy in the market.

3. Major trends guided by fundamental analysis.

The major trends mentioned above require operation in conjunction with large cycle k-lines. The major trends we will discuss next may not be as large as the above, but the space is absolutely solid, and they can be operated on smaller k-lines, which is also equivalent to major trends.

In the foreign exchange market, due to political events, economic data, changes in exchange rates, war factors, etc., they will all have an impact on the fundamentals, thereby guiding the trend. Therefore, major trends guided by fundamentals are relatively common.

For example, the recent conflict between Palestine and Israel is a very representative instance.

On October 7, 2023, Hamas suddenly launched a new round of military operations against Israel, firing thousands of rockets, and armed personnel also entered Israel. In response, the Israeli military carried out multiple rounds of airstrikes on the Gaza Strip.Due to the fact that October 7th fell on a weekend, trading was suspended, and the concerns only manifested in the market on Monday. Spot gold opened with a gap, starting at $1846, which was a $15 gap up, and in the following 20 days, it rose to a high of $2007, an increase of $160.

The rapid and significant increase in a short period of time is definitely considered a major market trend.

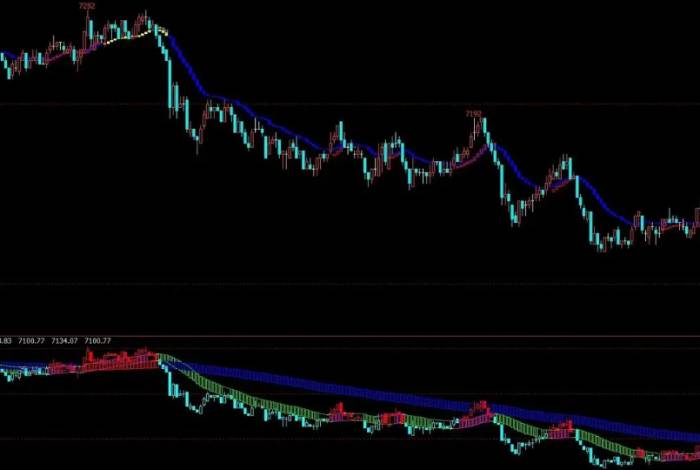

The chart shows the 1-hour candlestick chart of spot gold. After the gap-up opening, the market went through a simple consolidation and formed a continuous upward trend in the bull market.

In addition, the conflict event also affected crude oil futures.

Note:

This requires us to maintain sensitivity to important fundamentals, and we need to closely monitor all fundamentals and market dynamics in our daily activities, so that we can respond quickly and seize opportunities when they arise.

Furthermore, such market trends are usually accompanied by rapid rises and falls. In most cases, it is impossible to buy at the lowest point. In trading, one should be bold in entering the market, and can also use some technical methods for entry at smaller levels to operate, reducing the stop loss and increasing the profit-to-loss ratio.

4. Technical patterns in line with the general trend.

There are some technical patterns that have a long consolidation period, a small consolidation range, and sufficient accumulated strength. After the pattern breaks, it will also form a technical pattern that follows the general trend, which is the ongoing major trend we discussed at the beginning of our article.

The chart shows the 4-hour candlestick chart of the Euro against the US Dollar. The market started a bullish move from 1.06550, and after reaching 1.10240, it began a correction. During the correction, a very standard triangle consolidation pattern was formed.The lower edge of the triangle at 1.08370 serves as support, while the upper edge, as the consolidation period extends, is continuously compressing the space, accumulating strength. Once the triangle consolidation breaks, the market quickly moves into a significant trend. The breakout point's price was 1.08900, and the highest rise reached 1.12500.

There might be some confusion here: with so many consolidation break patterns, which ones will lead to a significant trend? Why doesn't the consolidation break pattern I'm working on lead to a significant trend?

That's because several key points about breaking the consolidation might have been overlooked. Let me summarize and categorize them for you.

(1) There is a very clear direction and trend in the early stage.

(2) The consolidation pattern is very neat, with high and low points that are very reasonable and easy to identify.

(3) The space of the consolidation pattern is small. In the image above, the triangle consolidation converges to a final space of only 50 points, severely compressed, and the market has no more room to oscillate, so it can only choose to break.

(4) The consolidation pattern has a long cycle. In the image above, the rising market trend lasted for 91 four-hour K-lines, while the consolidation pattern lasted for 68 four-hour K-lines, which is a sufficiently long consolidation period.

(5) The break must be a strong one, it must be a strong K-line that breaks through the consolidation pattern in one go, closing outside the consolidation pattern, and if followed by another strong K-line for validation, the accuracy will be even higher.

In summary, a trend that can be identified at a glance, followed by a consolidation pattern that can also be identified at a glance, after a long period of intensive consolidation, and finally a strong breakthrough, is the kind of pattern that leads to a significant trend after the consolidation break.

Note:There are many breakout patterns on the charts, but not many truly meet the above characteristics. To achieve a major trend like the one mentioned above, we need to wait patiently.

As the saying goes, opportunities will definitely arise, and they are worth waiting for.

What are the considerations for trading major trends?

1: Sometimes the four technical points mentioned above can form a resonance, such as a consolidation pattern that fits the major trend, which breaks through with the help of a fundamental news, creating a resonant effect.

2: Patience is key to trading major trends. Good opportunities in major trends are always rare, and many who cannot endure will be eliminated, so we need to have absolute patience.

3: Once the opportunity arises, we must be steady, accurate, and decisive. When it's time to act, we must not be soft-hearted, just like a sniper who takes decisive action after aiming at the target.

In fact, the methods for capturing major trends are not complicated, but they do test one's mindset. However, seizing one opportunity could yield a year's worth of profits, which is much more relaxed than the daily grind of trading, constantly struggling with the market. It's something to consider.

Comments