Moving averages are a very familiar indicator with a wide range of uses. Today, I will focus on explaining two upgraded strategies involving moving averages, namely the Moving Average Flow Strategy and the Guppy Moving Average Strategy.

Both of these strategies have a strong trend characteristic, which can be clearly identified on the chart and are very practical in actual combat.

So today, I will include them in one article for explanation, including their basic characteristics and practical applications, which I believe will be helpful to you.

The article is relatively long, so I suggest you bookmark it for reading to avoid losing it. If you find it rewarding, you can give me a like at the bottom of the article.

1: Guppy Moving Average

What is the Guppy Moving Average?

The Guppy Moving Average is an indicator composed of two sets of moving averages, invented by an Australian investment expert named Darvas Guppy, hence the name. The Guppy Moving Average consists of short-term and long-term groups.

The parameters for the short-term group are 3, 5, 8, 10, 12, 15.

The parameters for the long-term group are 30, 35, 40, 45, 50, 60.The chart is a 1-hour candlestick chart of spot gold, with the Gu Bin moving average indicator loaded. The red moving average at the top is the short-term moving average group, and the black moving average at the bottom is the long-term moving average group.

I have marked the changes in the Gu Bin moving averages during this market segment in the chart.

The long-term moving average on the left side diverges upward, indicating a clear trend in the bull market, but the short-term moving averages above are interwoven and the trend is chaotic.

As the market continues to develop, the long-term moving average still maintains the bull market unchanged, but there is confusion within the short-term moving averages again.

In the middle, the long-term and short-term moving averages are interwoven and stuck together, and the direction here is chaotic, so trading is paused (in the yellow rectangle in the chart).

Afterward, the market continues to diverge upward, the long-term moving average enters a clear bull market again, and the short-term moving average continues to be bullish after a brief period of chaos.

In practice, when the direction of the long-term moving average is clear, the confusion of the short-term moving average does not affect our long-term judgment of the trend. Instead, the short-term chaos indicates that the market is entering an adjustment, and the next opportunity is to enter the market in line with the trend.

Summarized in one sentence: When the direction of the large cycle is clear and the direction of the small cycle is chaotic, trade in the direction of the large cycle. When both the large and small cycles are chaotic, stop trading.

This is the simplest and most practical logic of Gu Bin moving averages.

What are the characteristics of Gu Bin moving averages?Easy to use, it can make a clear judgment on current trends, whether to go long, short, or wait, unlike other indicators that require analysis and thought, it can be seen at a glance to determine the direction of long or short, and can solve the problem of not being able to distinguish between long and short in actual combat, and the confusion of trading. As long as you learn and practice for a short period, you can master it.

This is a schematic diagram of the trend judgment of the Guppy Moving Average, with a total of 4 varieties.

On the left, the upper part is the 1-hour K-line of the British pound against the US dollar. The long-term moving average is downward and in a short position, the time cycle for the market to turn short is very short, and the market is in the early stage (I have marked it with a red rectangle in the picture).

Below is the 1-hour K-line of the euro against the US dollar. The long-term moving average is in a short position, and the time cycle for the market to turn short is longer, and the market is in the middle stage (I have marked it with a red rectangle in the picture).

On the right, the upper part is the 1-hour K-line chart of gold. The long-term and short-term moving averages are intertwined, and the trend is not clear, so wait for the time being.

On the lower right is the 1-hour K-line chart of the US dollar against the Japanese yen. After a period of decline, the moving average began to flatten, and the K-line also stood on the moving average. At this time, there is an expectation for the market to turn from short to long, but it needs to wait for the long-term moving average to turn up before it can be confirmed as long, and it is still in the observation and waiting period.

With the chart in front of you, you can judge at a glance whether the direction is long or short.

Since the Guppy Moving Average can not only clearly observe the market situation, but also is very easy to use in actual combat, I will explain a practical method of the Guppy Moving Average next.

The practical method of the Guppy Moving Average.

When the direction of the long-term Guppy Moving Average group is clear, observe the trend changes of the short-term Guppy Moving Average group. When the short-term and long-term trends are synchronized, open a position to enter the market.The chart shows an hourly candlestick chart of the Euro to US Dollar exchange rate.

After a significant uptrend, the market entered a consolidation phase, with short-term and long-term moving averages frequently crossing and sticking together, indicating a trendless period.

Subsequently, as the market reached a new high, the long-term moving averages began to diverge upwards, confirming a bullish trend, at which point one would prepare to go long.

The chart is an hourly candlestick chart of the Euro to US Dollar exchange rate.

For clarity, both the left and right sides of the chart are at the hourly level; on the left, I have shrunk the candles for a more comprehensive view, and on the right, I have enlarged the candles to show details.

After the long-term moving averages diverged upwards and the trend turned bullish, one would observe the short-term moving averages. After crossing downwards and sticking together, the short-term moving averages also began to cross upwards and diverge, creating a bullish expectation. At this point, one would open a long position, placing a stop loss at the low point of the pullback.

After the order was entered, the market continued to rise. After two weeks of consecutive increases at a high level, the short-term moving averages first broke downwards through the long-term moving averages, signaling a potential reversal. Then, the long-term moving averages also turned from bullish to bearish, forming a death cross and diverging downwards, indicating a bearish trend. At this point, one would close the long positions.

I have marked four blue rectangles on the chart, all of which are positions suitable for adding to the position. As long as the long-term moving averages remain bullish, and the short-term moving averages cross downwards and then diverge upwards after a pullback, it is a trading opportunity to add to the position.

Additionally, this trading logic can also be applied to swing trading. After entering the order, one would close the position when the market rallies. As long as the long-term moving averages do not change direction, and the short-term moving averages consolidate after a period of fluctuation and then diverge upwards again, it is a signal to open a swing trade. After opening the position, one would close the position when the market rallies again, waiting for the next trading opportunity.

The four rectangles I have marked on the chart are also the entry points for swing trading.I suggest that everyone engage in swing trading. The trend shown in the chart is a very smooth market movement. It is certainly good to capture the profits of the major trend, but when encountering a less smooth market, swing trading can allow for timely closing of positions to lock in profits. Being able to secure profits in a timely manner is also very good.

2: Moving Average Flow

What is the moving average flow?

The moving average flow is also a technical method that combines multiple moving averages. There was a famous long-term profit expert in the early days named Stanley Kroll, who turned $18,000 into $1 million, and he also used the moving average flow in his methods.

The moving average flow we use now has undergone some changes. Generally, multiple moving averages are added, such as 4, 9, 18, 35, 50, and some traders will also add a long-term moving average, such as 120, to form the moving average flow.

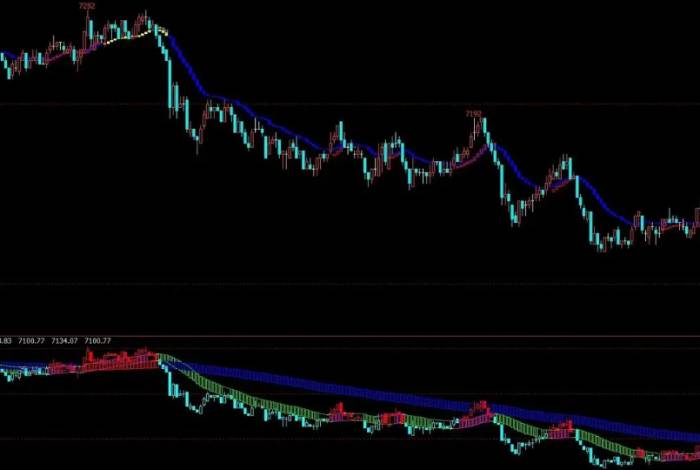

Please see the image below, which is a candlestick chart with the moving average flow added.

The chart adds 4, 9, 18, 35, 50, and 120, a total of 6 moving averages.

What are the characteristics of the moving average flow?

(1) The chart is simple and easy to read, facilitating market analysis.

You can clearly see on the chart above that the 120-day moving average serves as the dividing line between long and short positions. All the moving averages with smaller parameters have a certain distance from the 120-day moving average, which can be used as a standard for short-term market changes. The trend is long and short, and the two do not interfere with each other, making it clear and simple.If you find your charts to be chaotic and lacking a sense of direction, you can replace all the other indicators on the chart with a moving average flow and give it a try.

(2) The moving average flow is a trend-oriented indicator, which performs better in trending markets. Moreover, the short-term moving average has a smaller parameter, which is also useful for early identification of oscillations.

Practical methods of moving average flow.

I will directly share a dual-period moving average flow trading system with you.

The moving average flow has a strong trend characteristic. In practice, once a large cycle trend is formed, the trendiness of the moving average flow will last for a long time. At this point, you can trade in a band within a smaller cycle, following the trend of the larger cycle.

The chart shows the candlestick chart of the Euro against the US Dollar, with the left side being the 1-hour candlestick and the right side being the 15-minute candlestick. The chart includes the technical indicators of the moving average flow.

On the left side of the chart, at the 1-hour level, the market has broken through the 120-day moving average from bottom to top, and the 120-day moving average has started to turn upwards, indicating a bullish trend.

Switch to the 15-minute level at this time, and for the moment, the 15-minute moving average flow is bearish, with the short-term moving average below the 120-day moving average. Wait for the short-term moving average to transition from bottom to top, and once the 15-minute moving average flow crosses above the 120-day moving average, look for opportunities to enter on a breakout.

The left side of the chart maintains the bullish trend at the 1-hour level, and the angle at which the moving average turns upwards becomes larger, approaching 45 degrees. This is a relatively healthy trend angle, indicating that the bullish trend continues and shows a tendency to strengthen.The 15-minute moving average flow on the left is also beginning to form a bullish trend, with entry after the formation of a bullish breakout in the K-line, and stop-loss set at the low point of the pullback.

At the 1-hour level, the moving average flow has consistently maintained a very healthy bullish trend, but the 15-minute moving average flow has experienced several transitions between bullish and bearish (indicated by the blue arrows on the right side of the chart). Each time the market transitions from bearish to bullish and forms a breakout, it presents an opportunity for entry (marked by the three red circles in the chart). After entry, orders are taken profit in batches.

3: Matters needing attention

There are some details in these two strategies that require our attention:

(1) The moving average parameters in the moving average flow are not fixed; they can be set according to personal preferences. For example, I prefer a greater distance between long-term and short-term moving averages, which makes the short-term moving averages more conducive to observation and analysis, and the trend guided by the long-term moving averages is more stable and enduring.

The parameters of the Guppy moving averages can be used by default, or they can be adjusted according to individual preferences.

(2) These two indicators have a very broad range of applicability, including stocks, futures, and foreign exchange, and they can adapt to different time frames, whether it's daily or 5-minute, 1-minute charts, they can be used. They can be used to follow the trend and take advantage of the trend, or to make swing trades in the direction of the moving average flow.

Of course, before applying these two indicators in actual combat, they should be tested and practiced through backtesting to become proficient before actual use.

(3) These two indicators are excellent primary indicators for tracking trends and respond quickly to market movements. However, their quick response can lead to "false signals" in volatile markets, which can easily generate false signals.It is recommended that when using these two indicators to determine direction and trade, one should opt for a relatively conservative approach. This way, in practical application, it can filter out some false signals from volatile market conditions, leading to a more stable outcome.

Comments