In fact, behind this question lies a more fundamental demand, which is: how can one predict future trends in trading to accurately determine when to expect a pullback and when the trend has already reversed?

Today, I will also use this question as an opportunity to discuss a deeper understanding of trends in trading.

1. The future is unpredictable, and if one becomes obsessed with predicting the future, trading may be a dead end.

I once spent two years being very fixated on finding various technical methods to predict the future.

I believed that there must be a mysterious technique that could accurately judge the trend, know the direction of long and short positions, and also know where the pullback is and where the trend is about to reverse.

However, after many years of ups and downs, the reason why I have made some profits in trading is also because I have given up this obsession.

The future market is unknown, and no matter what technical methods you use, you cannot 100% accurately judge the details of the future trend. All trading results are distributed in a probabilistic manner, and what we need to do is to increase the probability of profit, which is the possibility of making money.

2. Each trade is a trial and error, and do not delude yourself into thinking you can get every trade right.

Many people feel pain when trading, especially when they make a wrong judgment.

But we must understand that the future is unpredictable, we are not immortals, and we cannot judge every future result correctly. Therefore, for us, each trade is an opportunity for trial and error. If it's right, take profit; if it's wrong, cut loss. If the amount of profit taken is greater than the loss cut, then our trading is profitable.My current trading method is as follows: after each order is placed, I set a stop loss to control the potential losses that may occur after a failed trial. I also set a take profit to ensure that when the trial is successful and the market moves in the expected direction, I can close the position reasonably and secure the profits that should be made. This way, I am not afraid of losses, and I can hold onto profits. The focus should be on the long-term profitability.

Remember, the basic logic of trading should not be "being right every time," but rather "overall profits outweigh overall losses." Just as there are peak and off seasons in a tourist area, you cannot expect to make money every season. However, if the profits from the peak season can cover the losses from the off season, and there is an overall profit, then the business can continue.

3. The existence of a trading system is to give our trades statistical significance.

In essence, a trading system is about establishing our own trading criteria. For example, when the market retraces and meets the entry criteria of the trading system, we can enter the market and set stop losses and take profits. If the market retraces and then resumes its original trend, our orders can be closed with a profit. If the market does not retrace but has reversed, our orders will strictly stop the loss.

Let me give you an example.

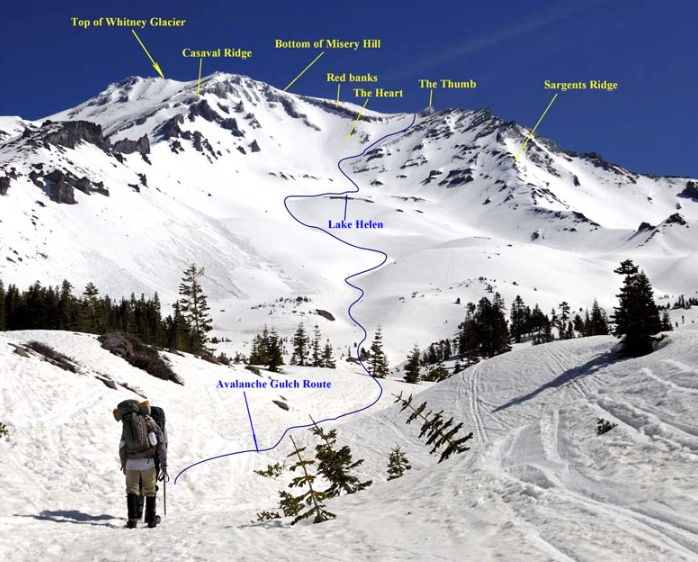

Using the Fibonacci retracement as the standard for the retracement, when the market retraces and tests the support band between the 38.2% and 61.8% Fibonacci levels, and a reversal candlestick pattern forms, we enter the market. The stop loss is set at the low point of the market's initial wave. See the picture.

The picture shows the candlestick chart of spot gold, with both the left and right sides being 15-minute candles.

On the left side of the chart, the market moved up from 1972 to 1990, forming the initial wave. After the initial wave was established, the market retraced and formed a bullish engulfing pattern between the 382 and 618 levels. At this point, we entered the market, and the market retraced ended, continuing to move in a bullish direction. This was a successful trial trade.

On the right side of the chart, the market moved up from 1953 to 1964, forming the initial wave. After the initial wave was established, the market retraced and formed a bullish engulfing pattern near the 382 level. At this point, we entered the market, but the market only made a simple upward retrace and then continued to move in a bearish direction, eventually breaking the previous low at 1953. This was an unsuccessful trial trade.With the technical criteria for trial and error, combined with capital management, all the elements for profitable trading are in place.

Capital management refers to the amount of principal we invest in each trade and the expected profit amount. For example, if each trial and error fails, our loss is 1. If each trial and error succeeds, the profit is 2, which means a profit-to-loss ratio of 2:1. Theoretically, as long as the success rate of trading trials is higher than 33%, overall trading can be profitable.

Therefore, most of our energy does not need to be focused on predicting which future market movements are retracements and which trends have reversed. We just need to know which market pullbacks meet the entry criteria of our trading system, and then we enter the market. If we are wrong, we cut our losses; if we are profitable, we take our profits. Other efforts can be directed towards optimizing our entry criteria and balancing the success rate with the profit-to-loss ratio.

Thus, trading requires letting go of obsessions, facing reality, in order to achieve true profitability.

Comments