Many people have heard the term "fund management" and understand its importance, yet they are unclear about what it truly entails. Fund management refers to the rational use of one's capital in trading to achieve a stable mindset and maximize profits. This includes determining the position size for opening trades, controlling the stop-loss at a certain amount, setting profit targets, managing risks during system downturns, and the operation of compounding positions after making profits, all of which fall within the scope of fund management.

If we liken trading to a war, then trading techniques are your spear, while fund management is your shield. Both are indispensable in helping us control risks, secure profits, and achieve profitability.

In today's article, I will discuss three specific methods of fund management that are very practical and can be directly applied with some small tips that I believe can be helpful to you.

1. Why is fund management so important?

I am often asked the same question: How much position should I use? Why do I suffer significant losses with heavy positions and make small profits with light positions? How should I control the position size?

In fact, behind such questions lies a hidden doubt: How can we accurately predict the market trend? Because only by knowing with precision whether the future will rise or fall can we adjust our positions accurately, going heavy when we can make a profit and reducing positions quickly when a loss is imminent.

Here, it is crucial to correct a significant misconception: Trading techniques have their limitations. We are in trading, not fortune-telling; we cannot be right every time. Trading inevitably involves both right and wrong decisions, as well as profits and losses.

At this point, without adjusting anything, the distribution of right and wrong should be relatively balanced, which is about a 50-50 split. If we want to make money, we must gain an advantage in the profit-to-loss ratio and the success rate, which involves planning for fund management.

For example, if we set a 40% success rate and a 2:1 profit-to-loss ratio, out of 100 trades, there will be 60 losses and 40 wins. If we make a profit of 100 on the winning trades and a loss of 50 on the losing trades, then after 100 trades, our earnings would be 100x40 - 50x60 = 1000.Thus, we do not need to predict the correctness of every future transaction; we just need to control the success rate + risk-reward ratio, as well as a reasonable position size, to achieve profitability in trading.

Of course, there are many techniques for setting up capital management, and I will now share three that I use more frequently in real combat with you.

Technique 1: Trade a Fixed Number of Lots

Fixed lot trading refers to using a fixed position size for every transaction, which is a simpler rule for capital management.

For example, opening a position with 1 lot, 2 lots, or 5 lots each time. This way, there will be no situation in the trade where a large market movement is made, but because the position is small, only a small profit is made. As long as the profit points of all orders are greater than the loss points, the trade can be profitable.

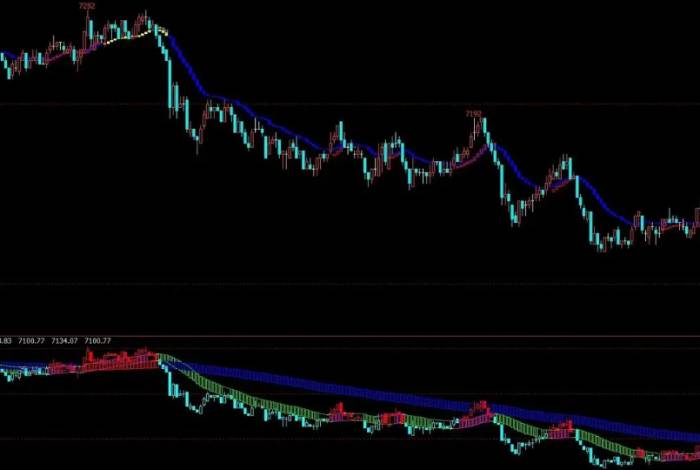

Next, I will explain the details and characteristics of this operation method in combination with real combat, and everyone can look at a picture.

The picture is a 1-hour chart of the Euro against the US Dollar, with a total of 10 transactions, opened with a fixed position of 1 lot, using the logic of trend line break trading.

Let's summarize the technical characteristics of this position management method:

(1) The amount of the stop loss is not fixed. Since the distance between the trend line break point and the previous high and low stop loss points is not fixed, the position size for each opening is fixed at 1 lot, so the amount of the stop loss for each transaction is not fixed. When the stop loss space is large, the stop loss amount is large, and when the stop loss space is small, the stop loss amount is small.

The largest stop loss in the picture, which I have marked with a blue rectangle above, reached a stop loss space of 70 points, and the smaller stop loss spaces were around 20 points.(2) The amount of profit and loss is not fixed, varying in size. In the bottom right corner of the chart, I have marked it with a blue rectangle, indicating that during a strong market, profits can reach over 1000, and during a weak market, they can be just over 200.

(3) Execution is relatively simple. There is no need to adjust positions or calculate amounts each time the market opens, making it convenient and fast.

Considering these characteristics, there is a crucial point to note when using this capital management method: the position must be light. Since the stop-loss space is not fixed, if a trade with a large stop-loss space is encountered, one might be hesitant to open a position due to the fear of a large stop-loss amount, or if the position is opened, one might not be able to hold onto it, affecting the execution.

Technique 2: Fixed Stop-Loss Amount

A fixed stop-loss amount means that the amount of the stop-loss is constant for each trade, such as 1000 or 2000, or calculated as a percentage of the principal, like 1% or 3% of the principal, etc.

The stop-loss space for each trade is different, and to maintain a fixed stop-loss amount for every trade, one needs to adjust the position size, which is often referred to as "position sizing based on the stop-loss."

The formula for calculation is: Stop-Loss Amount / Stop-Loss Space = Position Size.

For example, if the stop-loss amount is 2000 yuan and the stop-loss space is 500 pips, the position size for opening would be 2000/500 = 4 lots.

The chart shows a 1-hour candlestick chart of the EUR/USD, also with 10 trades, using a fixed stop-loss of 2% of the principal as the standard. The principal is 10,000 yuan, with a 2% stop-loss, meaning each stop-loss is 200 yuan.In the chart, you can see that to control the stop loss, the position for each opening is different. I have marked it with a blue rectangle in the chart.

Within the blue rectangle, I have used two red circles to mark the orders with the largest and smallest positions.

The first order opened a position of 0.85 lots, calculated by the formula: $200 / stop loss of 240 pips = 0.85 lots, which is the largest position order.

The smallest order, due to the larger stop loss space, only opened a position of 0.12 lots. The calculation formula is: $200 / stop loss of 1600 pips = 0.12 lots.

Note that the pips mentioned in these two orders are mini pips, and when calculating the position, sometimes it cannot be divided exactly, and only the position can be rounded, which does not affect the overall profit.

The trading amounts for the two stop losses in the chart are also around 200, which I have marked with two red circles in the lower right corner of the chart.

This mode of operation has a fixed maximum stop loss amount for each opening, and you know that the worst result of this trade is a loss of 200, even if it is a large space stop loss, so the psychological pressure is much less.

Let me tell you the precautions:

(1) This mode of operation requires us to calculate the position before each trade opening, which is more complicated. In foreign exchange trading, the point value of many currencies is not calculated in US dollars.

For example, for the US dollar against the Swiss franc, each pip is calculated in Swiss francs. When calculating the position, you need to convert the exchange rate between Swiss francs and US dollars. Currencies ending in pounds and those ending in yen have such issues, making the calculation more complex.In futures trading, the point value of different products also varies, and the calculation is equally complex, which is something to pay attention to in practical operations.

(2) This model is more suitable for swing trading with a fixed profit and loss ratio, such as the trade mentioned above, where the fixed stop-loss amount is 200, and the profit-taking occurs at a 2:1 profit-loss ratio, i.e., when the profit reaches 400. The calculation and execution are very convenient.

Fixed position and fixed stop-loss are the two most basic and widely used capital management techniques. Almost all trading systems, whether long-term, medium-term, or short-term, can be operated in conjunction with one of these methods.

On the basis of these two methods, there is also an advanced capital management technique that I would like to share with you today.

Technique 3: Increase position with profits to improve the utilization rate of funds

Many traders have experienced this: once there is a profit in the account, the trading becomes more relaxed, the position is increased arbitrarily, and the selection of trading signals is not rigorous. After making money, it's easy to get complacent, and soon after the joy, losses begin.

So after the account is profitable, we also need to have a complete set of capital management rules.

For example, use the existing profits to increase the position, improve the utilization rate of funds, expand profits, and make the good even better.

How exactly should this be done? I will explain with an example, and everyone can refer to the picture.

The picture shows the 1-hour chart of the Euro against the US Dollar, which is identical to the first picture in today's article. The fixed trading hand rule is used, and the orders made are the same. However, after the account is profitable, the position is increased proportionally, with an increase of 0.1 hand for every additional profit of 1000.In the blue rectangle of the chart, you can see that the first trade opened with 1 contract, resulting in a profit of 1314. Subsequently, the second trade started with an opening of 1.1 contracts. After the second and third trades were completed, the profit reached over 2000. When the fourth trade was opened, the position was adjusted to 1.2 contracts, and the operation has been maintained at a position of 1.2 contracts since then.

After completing these 10 trades, the overall profit amount is 2470. Looking back at the first image, if the operation of increasing position size was not used, the profit would be 2129, which means the profit has increased.

At the same time, because we have established a complete set of rules for position management after profit, there are regulations. Even if there is a profit, the operation of the trade will not be chaotic, the mentality is more stable, the execution is stronger, and the trade will be better and better.

Similarly, the trading logic of using a fixed stop-loss amount can also be operated in this way. For example, for an account of 10,000 US dollars, a 2% stop-loss amount is 200 US dollars. When the profit of the account's principal reaches 11,000, the 2% stop-loss amount becomes 220 US dollars.

This compound operation mode will produce very good results as the principal increases, but the process is relatively long and requires patience.

Let's talk about a few points to note for fund management:

(1) The rules of fund management should be combined with the details of the trading system.

Some friends may wonder, assuming I use a fixed position rule for trading, what standard should my trading system use? 1 contract, 2 contracts, 3 contracts, or 5 contracts?

This specific standard needs to be combined with the specific trading system because each trading system has different trading frequencies, success rates, and consecutive error rates.

Especially the consecutive error rate, if the consecutive error rate is high, a lower position should be used. Otherwise, there will be a large drawdown in the consecutive errors, the account will be at risk, and our trading mentality is also prone to lose control.Having a low rate of consecutive errors allows for the use of higher positions, resulting in smaller account drawdowns and lower risk during a streak of losses, making it easier to maintain a stable mindset.

Therefore, before deciding on the position size to use, it is crucial to clearly understand the statistics of your trading system and set standards based on the data.

(2) It is better to use a lighter position rather than a heavier one.

In fact, our trading mentality is closely related to the lightness or heaviness of the position. For instance, if we encounter consecutive stop losses during trading, a lighter position means a smaller total amount of stop losses, which reduces psychological pressure and allows for continued execution. However, if consecutive stop losses are coupled with heavy positions, the amount of stop losses is significant, leading to immense psychological pressure, and this can cause hesitation and timidity in subsequent executions.

In reality, most traders can understand the market trends and know when to enter and exit, but under the pressure of heavy positions, they tend to become mentally tense, which can lead to making wrong or foolish decisions.

A lighter position may result in smaller profits, but it ensures that you can actually keep what you earn, which is much better than the outcome of heavy positions that ultimately lead to losses. It is better to make small profits than to suffer significant losses.

(3) Regarding the issue of withdrawing funds.

Withdrawing profits is also a part of our capital management, and we encourage everyone to withdraw a portion of their funds after the account shows a profit (for those who want to compound interest, they can withdraw half and keep half). This can help to mitigate some of the risks associated with trading.

At the same time, because money in the market can seem like just a series of numbers, it can blur our perception of money. Withdrawing money and using it in real life can help establish a clearer and more accurate view of money.

Otherwise, trading can become like playing a game for us, where all the money feels like game currency, and we may not take each trade seriously. This can lead to indulging our desires, which can result in losses.

Comments